Introduction

As consumers, credit scores play a significant role in our financial lives. Whether you’re considering a personal loan, mortgage, or credit card, your credit score can impact the interest rates you receive and the overall terms of your financing. In this article, we will delve into the world of credit scores and explore how LendingClub, a leading online lending platform, utilizes credit scores to provide personalized loan options to borrowers. We will cover the basics of credit scores, understand their importance, and discover how LendingClub incorporates credit scores into its lending process.

Table of Contents

- Understanding Credit Scores and Their Significance

- The Role of Credit Scores in LendingClub’s Loan Offerings

- How to Determine Your Credit Score

- FICO Credit Score Range

- Factors Influencing Credit Scores

- LendingClub’s Personal Loans: A Brief Overview

- Loan Amounts and Terms

- LendingClub’s Approach to Credit Scoring

- Frequently Asked Questions (FAQs)

- What is considered a good credit score?

- Can I get a personal loan from LendingClub with a low credit score?

- How does LendingClub assess loan interest rates based on credit scores?

- Does LendingClub offer credit score monitoring services?

- Can improving my credit score help me secure better loan options?

- Conclusion

Understanding Credit Scores and Their Significance

Credit scores are numerical representations of an individual’s creditworthiness. They reflect the likelihood of a borrower repaying their debts based on their past credit history. Lenders use credit scores to evaluate the risk associated with extending credit to a borrower. A higher credit score indicates a lower credit risk, making borrowers more attractive to lenders.

The Role of Credit Scores in LendingClub’s Loan Offerings

LendingClub, a prominent online lending platform, considers credit scores as an integral part of its loan offerings. LendingClub evaluates borrowers based on their credit scores and other relevant factors to determine loan eligibility, loan amounts, and interest rates. By leveraging advanced algorithms and data analysis, LendingClub matches borrowers with investors, facilitating a streamlined borrowing process.

How to Determine Your Credit Score

To understand how your credit score may impact your eligibility for a loan from LendingClub, it’s essential to grasp the fundamentals of credit scoring.

FICO Credit Score Range

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. A higher score indicates a lower credit risk. While different lenders may have varying criteria for evaluating credit scores, a FICO score above 720 is generally considered strong and may result in more favorable loan terms.

Factors Influencing Credit Scores

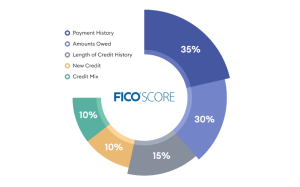

Several factors influence credit scores, including payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Payment history carries significant weight and involves assessing whether you have made timely payments on previous debts.

LendingClub’s Personal Loans: A Brief Overview

LendingClub offers unsecured personal loans, providing borrowers with a flexible financing option for various purposes. Whether you’re planning to consolidate debt, cover medical expenses, or make a significant purchase, LendingClub aims to match borrowers with suitable loan options based on their credit profiles.

Loan Amounts and Terms

LendingClub offers personal loans ranging from $1,000 to $40,000, allowing borrowers to find the loan amount that best meets their needs. Loan terms typically range from 36 to 60 months, providing borrowers with manageable repayment periods.

LendingClub’s Approach to

Credit Scoring

LendingClub understands the significance of credit scores in the lending process and utilizes them to assess borrower eligibility and determine interest rates. While credit scores are an essential factor, LendingClub takes a holistic approach by considering additional criteria such as income, employment history, and debt-to-income ratio. This comprehensive evaluation enables LendingClub to offer personalized loan options that align with borrowers’ financial situations.

Frequently Asked Questions (FAQs)

- What is considered a good credit score?

- A good credit score typically falls within the range of 700 to 749. However, the definition of a good credit score may vary slightly depending on the credit bureau reporting the score and the specific lender’s standards.

- Can I get a personal loan from LendingClub with a low credit score?

- LendingClub considers borrowers with a range of credit scores, including those with lower scores. While a low credit score may impact the loan terms, LendingClub aims to provide accessible financing options to individuals with varying credit profiles.

- How does LendingClub assess loan interest rates based on credit scores?

- LendingClub uses a risk-based pricing model, meaning that borrowers with higher credit scores generally qualify for lower interest rates. However, other factors such as income and debt-to-income ratio are also taken into account to determine the final interest rate.

- Does LendingClub offer credit score monitoring services?

- While LendingClub does not provide credit score monitoring services directly, borrowers can access their credit scores through various credit monitoring platforms or credit bureaus. Regularly monitoring your credit score can help you stay informed about your financial standing and take steps to improve it if necessary.

- Can improving my credit score help me secure better loan options?

- Yes, improving your credit score can positively impact your loan options. A higher credit score demonstrates your creditworthiness and may qualify you for lower interest rates and more favorable loan terms. Making timely payments, reducing credit utilization, and maintaining a healthy credit history can contribute to improving your credit score over time.

Conclusion

Understanding the role of credit scores is essential when seeking financing options, such as personal loans. LendingClub considers credit scores along with other relevant factors to provide borrowers with personalized loan options. By maintaining a good credit score and managing your finances responsibly, you can increase your chances of securing favorable loan terms and accessing the financial support you need. Remember to regularly monitor your credit score and explore ways to improve it for future borrowing opportunities.

Note: The information provided in this article is for informational purposes only and should not be considered financial advice. It is always recommended to consult with a qualified financial professional for personalized guidance regarding your specific financial situation.