The cost of car insurance in Orlando, Florida can vary depending on several factors. These include the driver’s age, driving record, type of vehicle, and coverage options. On average, car insurance rates in Orlando are slightly higher than the national average. According to recent data, the average annual premium for car insurance in Orlando is around $1,500. However, it’s important to note that this is just an estimate, and individual rates may vary. To get an accurate quote, it’s recommended to contact insurance providers and provide them with specific details about your driving history and vehicle.

Why is Florida insurance so high?

According to Bankrate, Florida has the third highest car insurance rates due to its reputation as the third most dangerous state for driving. Insurance fraud is a major issue, to the extent that the Senate contemplated eliminating no-fault coverage in the 2023 legislative session.

WalletHub.com further explains that the rising number of uninsured drivers, escalating healthcare expenses, and the state’s exposure to severe weather conditions all contribute to the surge in insurance premiums.

Why cars are cheaper in Florida?

Purchasing a car in Orlando, Fl can be a cost-effective choice due to Florida’s tax-friendly environment. With no state income tax, you are exempt from paying taxes on your income. Additionally, Florida has lower sales tax rates compared to other states, making it more affordable to buy a car in the Sunshine State. Take advantage of the best car deals available in Florida.

Are there a lot of uninsured drivers in Florida?

Scott McCullough

Dec 21 2021

Recent data reveals that approximately 13% of drivers in the United States operate vehicles without insurance coverage. This translates to approximately 32 million uninsured drivers on the road nationwide. While each state has specific insurance coverage requirements for vehicle registration, many drivers allow their insurance policies to expire before renewing them.

The percentage of uninsured drivers varies across states, with Florida having the highest rate at around 26.7%. To address this growing issue, many insurance companies in Florida offer additional coverage options. Although this coverage may come at a slightly higher cost, it provides protection for you and your family in the event of a collision with an uninsured driver.

Is health insurance required in Florida?

Each year, employers are required by the Internal Revenue Service to provide individuals with Form 1095. This form serves as proof of having minimum essential health insurance coverage. Since 2014, the Patient Protection and Affordable Care Act (ACA) has mandated that most individuals maintain health insurance coverage or face potential penalties. Although the federal monetary penalty has been repealed as of 2022, Washington DC, California, Massachusetts, New Jersey, and Rhode Island have implemented their own versions of penalties. Regardless of the possibility of facing a penalty, it is important for individuals to have minimum essential coverage for themselves and their dependents. The term “minimum essential coverage” is defined in the ACA and its accompanying regulations. This coverage is provided through the State Group.

Why is Florida a no fault state?

Florida is known as a no-fault state because of its law that requires insurance companies to pay out regardless of who caused a car accident. This type of insurance is also referred to as Personal Injury Protection (PIP).

There are two ways in which this law can affect your claim. Firstly, a person’s own insurance company covers the injuries of all parties involved, without considering their role in the accident. Secondly, the no-fault law prevents the injured person from suing the party responsible for the injury.

While it is not completely prohibited to sue, the law places restrictions on the right to sue, either by setting a monetary threshold or by allowing lawsuits only for certain types of injuries.

Florida is one of the 12 states that enacted this law in the 1970s to streamline the process of recovering damages after accidents. However, this system did not work as intended and instead led to higher auto insurance premiums for Floridians.

Aside from the increased premiums, the no-fault insurance law has had several other negative effects. Firstly, it is considered unfair because it pays out regardless of who is at fault, which limits the responsibility of reckless drivers. Secondly, it does not apply to property damage, so litigation costs are not reduced. Thirdly, both drivers are required to pay for insurance coverage, resulting in double the amount of coverage compared to the driver who caused the accident. Lastly, there is a significant amount of fraud, as medical providers and fake clinics file fraudulent claims to receive payments from no-fault insurance.

Is health insurance in Florida more expensive?

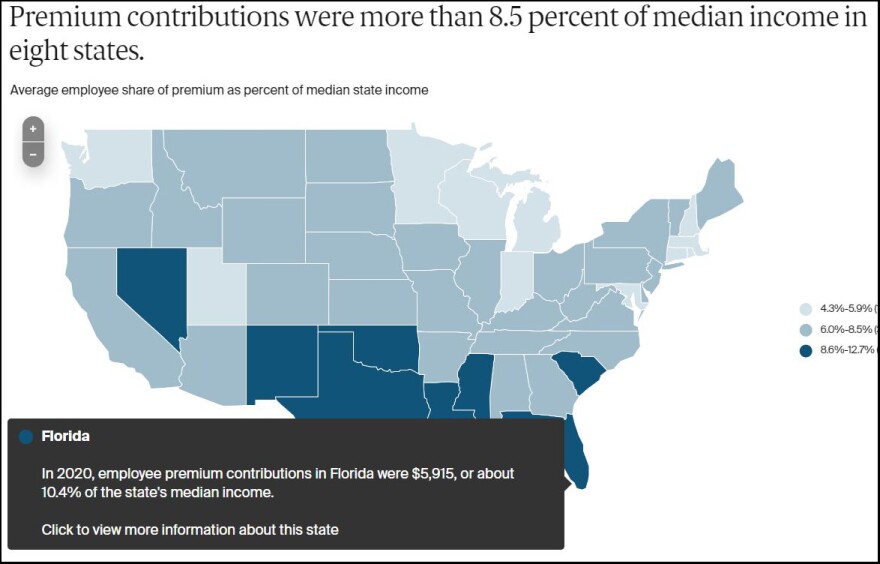

A recent study conducted by The Commonwealth Fund revealed that employees in Florida paid higher health insurance costs in 2020 compared to workers in most other states. The study analyzed the expenses associated with employee health insurance, including insurance premiums and deductibles.

In 2020, the average amount paid by Florida workers for premiums and deductibles was $9,284, which accounted for 16% of the state’s median income. This is a significant increase from ten years ago when Florida workers paid $5,205, or 11% of the state’s median income.

One of the main reasons for the high health insurance costs in Florida is that employers in the state do not cover as much of the expenses as employers in other parts of the country. Sara Collins, the lead author of the study and a vice president for Commonwealth, highlighted this disparity. While the overall cost of health insurance in Florida is comparable to the national average, employees in the state bear a greater burden.

Collins explained that workers in Florida pay a higher percentage of their premiums, which is one of the highest rates in the country. Additionally, the median income in Florida is significantly lower than the national average, exacerbating the cost burden for employees. This combination of factors creates a challenging situation where employees have less disposable income to spend on other necessities.

The study also revealed that families in Florida were particularly affected by high health insurance costs. On average, employees with family coverage had to pay 37% of their overall premiums, amounting to $7,674, which was the highest rate in the nation. For employees with single coverage, the rates were the third highest in the country, averaging $1,811.

Furthermore, the study found that health insurance deductibles in Florida averaged $2,147, ranking it among the 14th highest in the nation. Deductibles refer to the amount that employees must pay before their insurance coverage takes effect.

To address these issues, the study proposed potential solutions at a national level, such as expanding Medicaid eligibility and providing more subsidies for insurance plans on the Affordable Care Act’s marketplace. David Blumentahal, the president of The Commonwealth Fund, emphasized the need for policy actions to ensure affordable health insurance coverage for all Americans and to tackle the underlying high costs that make healthcare expensive.

In conclusion, the study highlights the significant financial burden faced by employees in Florida due to high health insurance costs. It underscores the need for policy interventions to make healthcare more affordable and accessible for all Americans.

Can you drive a car in Florida with no insurance?

If you are caught driving without car insurance in Florida, you are not alone. State officials estimate that 1 in 4 drivers in the Sunshine State do not have auto insurance as required by law.

Driving without insurance is illegal in Florida and can result in the suspension or revocation of your driver’s license.

At The Ansara Law Firm, our Fort Lauderdale traffic ticket attorneys will fight to protect your right to legally operate a vehicle in Florida if you are cited for driving without insurance. Depending on the facts of your case, you could face hefty fines and a loss of your license for months or even years. It is important to take action as soon as you receive notice that you have been caught driving without insurance.

Although some traffic crimes are prosecuted as criminal offenses in Florida, driving without car insurance is not one of them. However, it can quickly become a criminal charge if your license is suspended and you continue to drive. Taking action early on can help you avoid bigger headaches later.

Auto insurance is mandatory for those who are driving a vehicle or registering any vehicle with four wheels in Florida. The law requires drivers to maintain a minimum of $10,000 in personal injury protection (PIP) coverage and $10,000 in property damage liability.

Bodily injury liability coverage is not required by state law, but certain drivers, such as those convicted of DUI, are required to carry it. Most carriers offer minimum limits of $10,000 per person and $20,000 per accident.

If you have been found guilty or pleaded no contest to a charge of DUI, you must maintain higher limits of coverage for property damage, bodily injury liability, and per-accident bodily injury liability for at least three years post-conviction.

New residents to Florida cannot keep their old car insurance. The minimum required insurance must be issued through a Florida insurance agent employed by an insurance company licensed to sell it in Florida.

It should be noted that Florida’s many snowbirds and anyone who has a vehicle in Florida for more than 90 days during a 365-day period, even if those 90 days are not consecutive, must maintain insurance.

Registered vehicles must be insured regardless of whether they are being used or not. The only way to avoid a driver’s license suspension is to surrender the plate and registration to the local Tax Collector office prior to canceling the policy.

If your insurance lapses or you drop it and do not get new insurance right away, the Florida Department of Highway Safety and Motor Vehicles (DHSMV) has the authority to suspend your driving privileges, vehicle license plate, and registration for up to three years or until proof of Florida insurance is provided.

If your license is suspended because you are not properly insured, your reinstatement fee could range from $150 to $500, depending on if you have any prior insurance lapses.

Unlike some other states, there are no criminal penalties for failure to keep insurance in Florida. However, it is still important to address the situation quickly to avoid serious sanctions, including a license suspension.

Florida law enforcement agencies regularly crack down on uninsured drivers and issue citations for driving without insurance.

If you present proof of insurance to a law enforcement officer that you know is not current, you could be charged with a first-degree misdemeanor punishable by up to one year in jail.

If you receive a ticket for driving without auto insurance and want to fight it, we can help. We can take steps to mitigate your damages, secure SR22 or FR44 Certificates of Financial Responsibility forms, and help you fight any citations for failure to present proof of current insurance.

Contact the experienced Fort Lauderdale criminal defense lawyers at The Ansara Law Firm for a free consultation at 877-277-3780.<<<<<< h2>How much is car insurance in Florida for a 25 year old?

|

State

|

Insurer

|

Average monthly rate

|

|---|---|---|

| California | Geico | $133 |

| Florida | Geico | $148 |

| Georgia | Georgia Farm Bureau | $126 |

| Illinois | State Farm | $107 |

| Michigan | Progressive | $171 |

| New York | Progressive | $205 |

| North Carolina | Geico | $86 |

| Ohio | Geico | $105 |

| Texas | Fred Loya | $119 |

h2>How much is driving without insurance in Florida?

| Penalty type | First offense | Subsequent offenses |

|---|---|---|

| Fines | $150 | Up to $500 for subsequent offenses within three years of the first offense |

| License suspension | Lasts until reinstatement fee is paid and proof of noncancelable coverage is provided | Lasts until reinstatement fee is paid and proof of noncancelable coverage is provided |

h2>How much is average Geico car insurance in Florida?

| Florida Car Insurance Company | Overall Rating | Cost Rating |

|---|---|---|

| Geico | 9.1 | 9.2 |

| State Farm | 9.3 | 9.2 |

| Travelers | 9.0 | 8.8 |

| Farmers | 8.4 | 7.5 |

| Progressive | 8.7 | 8.7 |

h2>How much is car insurance for 24 year old in Florida?

| State | Avg. full coverage premium for a 24-year-old | Avg. full coverage premium in the state | Percentage increase for 24-year-old drivers vs. average |

|---|---|---|---|

| Alabama | $2,750 | $1,843 | 49% |

| Alaska | $2,732 | $1,946 | 40% |

| Arizona | $2,584 | $1,810 | 43% |

| Arkansas | $2,709 | $1,907 | 42% |

| California | $3,131 | $2,291 | 36% |

| Colorado | $3,015 | $2,121 | 42% |

| Connecticut | $2,293 | $1,553 | 48% |

| Delaware | $3,069 | $2,103 | 47% |

| Florida | $4,367 | $3,183 | 37% |

| Georgia | $2,929 | $2,085 | 40% |

| Hawaii* | $1,344 | $1,275 | 5% |

| Idaho | $1,763 | $1,133 | 56% |

| Illinois | $2,756 | $1,806 | 53% |

| Indiana | $1,888 | $1,295 | 46% |

| Iowa | $1,933 | $1,315 | 47% |

| Kansas | $2,767 | $1,878 | 47% |

| Kentucky | $3,214 | $2,124 | 51% |

| Louisiana | $4,149 | $2,909 | 47% |

| Maine | $1,503 | $941 | 60% |

| Maryland | $2,768 | $1,971 | 40% |

| Massachusetts* | $1,486 | $1,262 | 18% |

| Michigan | $3,871 | $2,691 | 44% |

| Minnesota | $2,458 | $1,760 | 40% |

| Mississippi | $2,530 | $1,771 | 43% |

| Missouri | $2,839 | $1,943 | 46% |

| Montana | $2,887 | $1,889 | 53% |

| Nebraska | $2,387 | $1,624 | 47% |

| Nevada | $3,948 | $2,779 | 42% |

| New Hampshire | $1,934 | $1,262 | 53% |

| New Jersey | $2,580 | $1,754 | 47% |

| New Mexico | $2,219 | $1,591 | 39% |

| New York | $4,261 | $3,139 | 36% |

| North Carolina | $1,563 | $1,446 | 8% |

| North Dakota | $1,795 | $1,302 | 38% |

| Ohio | $1,885 | $1,266 | 49% |

| Oklahoma | $2,680 | $1,998 | 34% |

| Oregon | $1,948 | $1,415 | 38% |

| Pennsylvania | $3,049 | $2,040 | 49% |

| Rhode Island | $2,740 | $1,886 | 45% |

| South Carolina | $2,230 | $1,532 | 46% |

| South Dakota | $2,095 | $1,553 | 35% |

| Tennessee | $2,099 | $1,429 | 47% |

| Texas | $2,824 | $2,019 | 40% |

| Utah | $2,126 | $1,510 | 41% |

| Vermont | $1,712 | $1,061 | 61% |

| Virginia | $2,206 | $1,439 | 53% |

| Washington, D.C. | $2,854 | $1,410 | 102% |

| Washington | $2,099 | $2,072 | 1% |

| West Virginia | $2,289 | $1,580 | 45% |

| Wisconsin | $1,918 | $1,292 | 48% |

| Wyoming | $2,299 | $1,582 | 45% |

h2>What is a livable salary in Florida?

| 1 ADULT | 2 ADULTS

(1 WORKING) |

2 ADULTS

(BOTH WORKING) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 Children | 1 Child | 2 Children | 3 Children | 0 Children | 1 Child | 2 Children | 3 Children | 0 Children | 1 Child | 2 Children | 3 Children | |

| Living Wage | $17.72 | $35.98 | $45.96 | $60.66 | $27.71 | $34.27 | $39.04 | $43.84 | $13.85 | $19.91 | $25.07 | $30.25 |

| Poverty Wage | $6.53 | $8.80 | $11.07 | $13.34 | $8.80 | $11.07 | $13.34 | $15.61 | $4.40 | $5.54 | $6.67 | $7.81 |

| Minimum Wage | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 | $11.00 |

h2>What is the best insurance license to get?

| Rank

|

Licensed Insurance Agent certification

|

Organization

|

|---|---|---|

| 1 | Certified Professional, Life and Health Insurance Program (CPLHI) | LOMA |

| 2 | Certified Nurse Assistant (CNA) | American Red … |

| 3 | Medical Assistant | ASPT |

| 4 | Certified Insurance Examiner (CIE) | IRES |

| 5 | Commercial Driver License (CDL) | FMCSA |

| 6 | Health Insurance Associate (HIA) | HIAA |

| 7 | Certified Pharmacy Technician (CPhT) | PTCB |

| 8 | Chartered Property Casualty Underwriter (CPCU) | The Institute… |

| 9 | International Accredited Business Accountant (IABA) | ACAT |

Conclusion

Conclusion:

In conclusion, Florida insurance rates are high due to a combination of factors. Firstly, the state’s unique geography and weather conditions contribute to a higher risk of accidents and damage to vehicles, leading to increased insurance costs. Additionally, the high population density and tourist influx in certain areas of Florida also contribute to a higher number of accidents and claims, further driving up insurance rates.

Furthermore, Florida’s status as a no-fault state plays a significant role in the high insurance costs. While the no-fault system aims to provide quicker compensation for accident victims, it also leads to increased insurance premiums as each driver is responsible for their own medical expenses, regardless of fault. This system can result in more frequent and costly claims, ultimately impacting insurance rates.

The prevalence of uninsured drivers in Florida is another factor contributing to the high insurance costs. Despite state laws requiring drivers to carry insurance, a significant number of individuals still choose to drive without coverage. This places an additional burden on insured drivers, as they may have to bear the financial consequences of accidents involving uninsured motorists.

When it comes to health insurance, Florida does face higher costs compared to some other states. Factors such as a large elderly population, higher healthcare utilization rates, and limited competition among insurance providers contribute to the increased premiums. Additionally, the absence of Medicaid expansion in Florida has also impacted the affordability and accessibility of health insurance for many residents.

Driving a car in Florida without insurance is illegal and can result in severe penalties. The state requires all drivers to carry minimum liability coverage to protect themselves and others in the event of an accident. Failure to comply with this requirement can lead to fines, license suspension, and even vehicle impoundment. It is crucial for all drivers in Florida to obtain the necessary insurance coverage to avoid legal consequences and financial hardships.

While health insurance is not legally required for individuals in Florida, it is highly recommended. The cost of healthcare can be exorbitant, and having health insurance provides financial protection and access to necessary medical services. Additionally, under the Affordable Care Act, individuals may face penalties for not having health insurance coverage. Therefore, it is advisable for residents of Florida to explore their options and consider obtaining health insurance to safeguard their well-being and financial stability.

Sources Link

https://www.valuepenguin.com/25-year-old-car-insurance

https://www.pnj.com/story/money/2023/05/19/florida-homeowners-insurance-on-the-rise-what-about-auto-insurance/70232953007/

https://www.bankrate.com/insurance/car/florida-driving-without-insurance/

https://www.marketwatch.com/guides/insurance-services/car-insurance-florida/

Best Time to Buy a Car in Florida | Is It Cheaper To Buy A Car In Florida?

https://www.rite4justice.com/florida-no-fault-insurance-explained

https://www.bankrate.com/insurance/car/24-year-old/

https://www.flafirm.com/resources/blog/florida-has-the-highest-rate-of-uninsured-drivers-in-the-us/

https://livingwage.mit.edu/states/12

https://wusfnews.wusf.usf.edu/health-news-florida/2022-01-20/employees-in-florida-pay-among-the-highest-rates-for-health-insurance-study-finds

https://www.zippia.com/licensed-insurance-agent-jobs/certifications/

https://www.ansaralaw.com/driving-without-car-insurance.html

https://www.mybenefits.myflorida.com/health/health_insurance_plans/health_insurance_mandates

You are watching: how much is car insurance in orlando florida