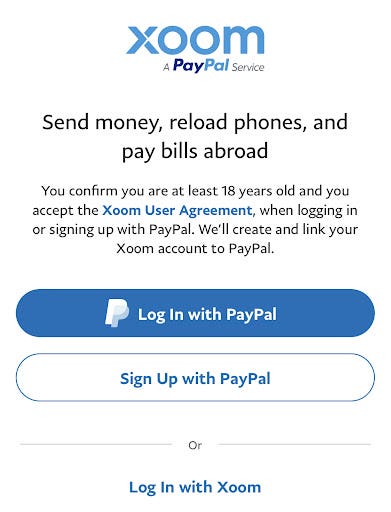

Yes, Xoom can send money directly to a bank account. Xoom is a secure and convenient online money transfer service that allows users to send funds to bank accounts in various countries around the world. By simply providing the recipient’s bank account details, users can initiate a transfer from their Xoom account. The funds are typically deposited into the recipient’s bank account within a few business days, making it a reliable option for sending money internationally. Xoom also offers competitive exchange rates and low fees, making it an affordable choice for transferring funds to a bank account.

Does Xoom work with any bank?

Send amount: 20000 USD

Receiving amount: 20000 USD

Show Fees

Send Now

New to Xoom? Sign Up Now

Send money to banks and cash pickup locations in the United States. Make bank deposits at Bank of America, Chase, Wells Fargo, and Citibank. Alternatively, you can send money for cash pickup at over 5000 convenient Walmart and Ria locations.

When someone sends you money on PayPal does it go to your bank account?

When money is sent to you through PayPal, it is deposited directly into your PayPal account. From there, you have the choice to keep the funds in your PayPal account as a credit or transfer them to your bank account or Visa debit card.

By keeping the money in your PayPal account, you can conveniently use it for future online purchases. PayPal will deduct funds from your PayPal account before using any funds from your linked card or bank account.

How do people receive money from Xoom?

Xoom, a service owned by PayPal, is a convenient and flexible option for international monetary transactions. It allows recipients to receive money through their bank account, debit card, or digital wallet. They can also pick up cash at various Xoom-affiliated locations worldwide or have cash delivered directly to them. Xoom users can pay international bills or add money to a prepaid mobile phone account.

However, the app may not offer as many benefits as some users would like. For example, bill payment is only available in eight countries, primarily in Central America, and a low fee is charged for this service.

The Xoom app is available for iOS and Android devices, and the service can also be accessed through the Xoom website. It is available in 16 languages.

Xoom partners with various money transfer services, including Xe Money Transfer and Wise MultiCurrency Account. These partners offer a wide range of currencies for transfer to over 130 countries. Xe Money Transfer provides fast and easy transfers with low to no fees, while Wise offers a multi-currency account with no monthly fees and multiple payment options.

Overall, Xoom provides a reliable and convenient solution for international money transfers, backed by the reputation and power of PayPal.

How to send $10,000 dollars to someone?

Ruth Sarreal and Spencer Tierney have updated this content on October 3, 2022. Yuliya Goldshteyn has edited it.

Please note that the products mentioned in this article are from our partners who compensate us. This may affect the placement and appearance of the products on the page. However, our evaluations are unbiased and our opinions are our own. Here is a list of our partners and how we earn money.

Discover the bank accounts that suit your financial goals by answering a few questions. Compare different bank accounts that meet your needs.

Here are our top picks for the best ways to send money:

– Best for mobile: Venmo

– Best for referral bonus: Cash App

– Fastest for domestic transfers: Zelle, Google Pay

– Most popular online: PayPal

– Best for nonbank transfers: Walmart2Walmart

– Best for sending $10,000 or more within the US: Bank wire transfer

– Cheapest for international bank-to-bank transfers: MoneyGram

– Fastest for international transfers: Xoom

– Best for transferring large amounts internationally: OFX

– Best for transfer options: Western Union

– Best for easy signup: Wise

When sending money online, the best method depends on how and where you want to send it. We have compared fees, speed, and other features to find the best domestic and international money transfer services. However, it is important to take precautions when using these services to ensure that you are sending money to the correct recipient. In most cases, you are not guaranteed a refund if your money is sent to the wrong person.

If you’re curious about the latest transfer service, learn about FedNow.

You can trust NerdWallet because our writers and editors adhere to strict editorial guidelines to provide fair and accurate coverage. This allows you to choose the options that work best for you.

To protect your money, find out how to avoid P2P scams and what steps to take if you encounter one.

For a summary of our top picks, see below.

Can I send money to a bank account?

xxxxx offers the advantage of having zero or low transaction fees, whether you’re sending money domestically or internationally. This means you can transfer funds to another person’s bank account or digital wallet without spending a significant amount.

One of the benefits of xxxxx is the processing time. Similar to mobile apps, these online payment systems allow for instant cash transfers. Once you send the funds, your recipient will see them shortly after.

Pros:

– Free or inexpensive fees

– Instant transfers

– Ability to cancel unclaimed payments

However, there are some potential drawbacks to consider. Some xxxxx services may have limits on the amount of money you can transfer. Additionally, certain services may charge inactivity fees. Lastly, the level of security provided by the online payment tool can vary.

Alternatively, you can choose to send a money transfer through traditional means, such as cash. This can be done by visiting a bank and depositing the funds into a bank account. For added convenience, self-service ATMs can be used, which offer the same level of assurance.

Bank of America, for example, has self-service kiosks that allow you to send money to another account. However, these ATMs only facilitate transfers between linked accounts and cannot send cash to another person’s bank account. If you need to send cash directly to a bank account, you can visit BOSS Revolutions’ retail partners, where you can send cash to a bank account anywhere in the world.

When using cash or self-service ATMs, it’s important to consider the associated fees. Different banks may have varying policies for self-service ATMs. For example, if you have a Bank of America account, you won’t be charged a fee for an ATM transfer.

In terms of processing time, most banks can process your transfer funds on the same day, especially if the transaction is completed early in the day. However, some banks may require two to three business days to process the transfer.

Pros:

– Self-service kiosks may accept cash, checks, and debit cards

– More secure compared to many online payment systems

– Faster than teller transactions

On the other hand, there are some potential cons to consider. Some banks impose limits on ATM transfers, so you may not be able to transfer large amounts of money. Additionally, not all ATMs or banks support money transfers, so it’s important to check if your chosen method is available. Lastly, using cash or self-service ATMs may require frequent trips to deposit cash.

Conclusion

Conclusion:

In conclusion, Xoom is a reliable and convenient platform for sending money to bank accounts worldwide. With its extensive network of partner banks, Xoom ensures that users can transfer funds to almost any bank account in the recipient’s country. This wide coverage makes it a popular choice for individuals looking to send money internationally.

When it comes to receiving money from Xoom, the process is straightforward. Recipients can choose to have the funds deposited directly into their bank accounts, making it easy and convenient to access the transferred funds. Additionally, Xoom offers other options such as cash pickup and home delivery in select countries, providing flexibility to recipients based on their preferences and needs.

If you are looking to send a substantial amount of money, such as $10,000, Xoom can accommodate your needs. By following a few simple steps, you can initiate a transfer of this amount through the Xoom platform. However, it is important to note that certain countries may have specific regulations or restrictions on the maximum amount that can be sent, so it is advisable to check the limits and requirements beforehand.

When it comes to PayPal, receiving money from someone does not automatically go directly to your bank account. PayPal offers various options for receiving funds, including keeping the money in your PayPal account, transferring it to your linked bank account, or using it for online purchases. The choice of how to receive the money is up to the recipient, and they can easily transfer the funds to their bank account if desired.

Overall, both Xoom and PayPal provide convenient and secure options for sending and receiving money. Whether you need to send money to a bank account, receive funds from Xoom, or receive money on PayPal, these platforms offer reliable solutions that cater to different needs and preferences. With their user-friendly interfaces and extensive networks, Xoom and PayPal continue to be popular choices for individuals and businesses alike in the realm of online money transfers.

Sources Link

https://www.bossrevolution.com/en-us/blog/transfer-money-someone-else-bank-account

https://www.xoom.com/united-states

https://www.forbes.com/advisor/money-transfer/xoom-review/

https://www.nerdwallet.com/article/banking/best-ways-to-send-money

https://beconnected.esafety.gov.au/articles-and-tips/paypal-how-does-it-work

You are watching: can xoom send money to bank account